Shareholders are the backbone of Bank of America, holding its shares and, by extension, pieces of the institution itself. These shareholders, whether individuals saving for retirement or large entities diversifying their portfolios, are essential.

They don’t just own shares; they have voting rights that can shape the bank's future, and they stand to gain from its profits. This group’s confidence in the bank is reflected in their investment, making their role in its governance and success pivotal.

Major Stakeholders of Bank of America

Zooming in on the individuals with considerable influence at Bank of America, we can see how their investment is not just monetary but also a commitment to their roles in steering the bank forward.

Thomas K. Montag’s Impact

With a shareholding of 2,310,714, accounting for 0.03% of Bank of America, Montag is more than the Chief Operating Officer. His investment underscores his dedication to smoothly running the bank's day-to-day activities. Ensuring operational excellence at Bank of America headquarters and beyond is part of his contribution to the bank's legacy.

Brian T. Moynihan’s Dual Role

As the CEO and Chair of the Board, Moynihan’s 1,718,119 shares, or 0.02% of the bank, signify a dual investment of leadership and financial stake. He doesn't just oversee Bank of America’s strategy and performance; he's directly invested in its prosperity. His role shapes the history of Bank of America, guiding it through the present and into the future.

Geoffrey S. Greener’s Stewardship

Greener, holding 868,253 shares (0.01%), embodies the bank’s commitment to risk management. His stake represents a personal investment in the bank's safety and soundness, reflecting the seriousness with which Bank of America headquarters approaches risk.

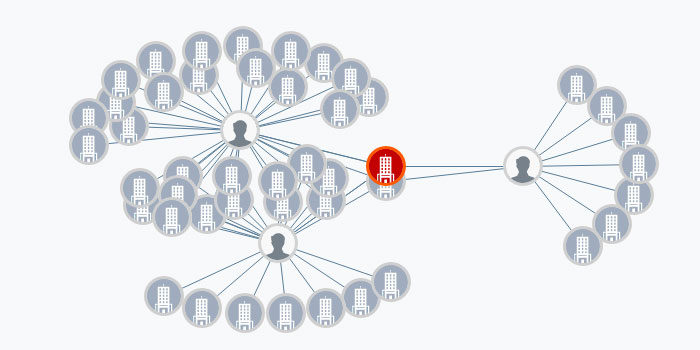

Top Institutional Shareholders of Bank of America

Bank of America counts several influential financial giants among its top shareholders. These institutions not only bring in significant capital but also add a layer of credibility and stability to the bank’s operations.

Berkshire Hathaway Inc.

When you see Berkshire Hathaway's name attached to an investment, it's akin to a seal of approval. With about 1 billion shares, which accounts for 11.7% of Bank of America's shares, Berkshire Hathaway’s investment is substantial. This level of commitment from the Omaha-headquartered investment giant does more than just pour money into Bank of America; it elevates the bank’s reputation in the eyes of current and potential shareholders.

Berkshire Hathaway's investment in Bank of America is deliberate. It shows careful consideration of the bank's growth and profitability potential. Berkshire's involvement gives Bank of America shareholders hope for the future. Berkshire Hathaway and the bank's headquarters have a long-standing strategic partnership.

Vanguard Group Inc.

The Vanguard Group’s stake in Bank of America is not just a portion of stock—it's a statement of trust in the bank's long-term prospects. Owning 613.5 million shares, equivalent to 7.1% of the bank's shares, Vanguard showcases its conviction in its value and management. For individuals exploring options to become Bank of America shareholders, Vanguard's investment is a positive indicator of the bank’s enduring appeal.

Vanguard's role as shareholders and strategic proponents is highlighted in every mention. Bank of America has made many decisions that align with Vanguard's investment philosophy: steady growth and a strong future. The bank's headquarters often discuss how Vanguard's investment shows their confidence in its future.

BlackRock Inc.

BlackRock’s ownership of 509.9 million Bank of America shares, or 5.9% of the total, is more than a financial position—it’s a significant nod to the bank's solid standing in the financial community. This New York-headquartered investment management firm is known for its strategic choices, and its substantial holding is a strong signal of its belief in Bank of America’s potential and performance.

BlackRock and Bank of America shareholders discuss investment stability and financial foresight. BlackRock's significant stake is often cited as evidence of institutional confidence in the bank's future. BlackRock's stake and its impact on Bank of America's growth are often discussed at headquarters.

Financial Strength Indicators of Bank of America

The financial health of the history of the bank of America can be assessed through some telling numbers. A $27.4 billion net income over 12 months is not just an impressive figure; it’s a concrete indicator of the bank's capability to generate profit and ensure returns to its shareholders. This performance is critical not only to those directly invested in the bank but also to the broader financial market, where the bank plays a substantial role.

With revenues reaching the $91.2 billion mark, the history of the bank of America demonstrates its prowess in generating sales and maintaining a robust business model. This figure isn’t just a testament to the bank's ability to attract business and reflects its effectiveness in capitalizing on its vast bank branches and services.

A market capitalization of approximately $284.6 billion places Bank of America among the titans of the banking industry. Such market value is indicative of the bank’s solid foundation and its perceived potential for future growth. It reassures shareholders and the financial community of the bank’s strong positioning.

Significance of Shareholder Confidence

When household investment giants like Berkshire Hathaway take a substantial position in a financial institution like Bank of America, it communicates volumes about the bank's reputation and prospects.

This isn't just about having deep pockets; it's about the confidence that these financial behemoths place in the bank's management and its strategic path. With Bank of America's headquarters being a hub for critical financial decisions, the involvement of such esteemed entities underscores the bank's steady positioning and trajectory for advancement.

This endorsement from shareholders who stand among the world's financial elite underscores a sense of security and potential for progress that can be crucial to the bank's ongoing success.

Leadership and Shareholder Security

Bank of America leaders holding shares show they believe in the bank's financial strategy and future, not just pride. These leaders are shareholders who care about the bank's performance.

From Bank of America's headquarters executives to its branches that carry its history, they are committed to its success. This alignment of interests between bank leaders and shareholders ensures that every decision improves the bank's value and enriches shareholders.