The financial services sector is intricate and versatile, offering various services to cater to customers' requirements. Asset management vs. wealth management are two of the most popular phrases in this field. These terms are frequently used interchangeably but refer to different facets of financial management. This article will compare asset and wealth management, discussing each discipline's place in the financial services sector and how its practitioners might help their clients.

Management Of Assets

"Asset management" refers to overseeing a client's financial investments, such as stocks, bonds, mutual funds, and other securities. Maximizing profits while limiting losses is the primary focus of asset management. Asset managers employ various techniques to accomplish these objectives, including diversification, asset allocation, and active management.

Client's investment goals, level of comfort with risk, and expected time horizon are all factors that asset managers consider when making recommendations. A specialized investment portfolio is then crafted to accommodate these requirements. In addition, asset managers constantly monitor the portfolio and make any required adjustments to keep it in line with the client's original investment thesis.

Handling Your Money Wisely

As a more general phrase, "wealth management" refers to a collection of financial products and services to assist clients in realizing their financial objectives. Wealth managers take a holistic approach to financial management, considering a client's overall financial status, including investments, taxes, estate planning, and more.

Long-term wealth preservation and growth are the major focus of wealth managers. An individual's risk tolerance, the time they are willing to invest, and the client's overall financial goals go into the detailed financial plan that the wealth manager develops with the investor. Investment management, tax preparation, estate planning, retirement planning, and other services may all be part of this package.

Wealth managers also offer their clients continuous support, guiding them through the complexities of the financial markets and guiding them toward well-informed investment decisions. To guarantee that their client's financial situations are handled properly, financial advisors may collaborate with other experts like lawyers and accountants.

The Distinctive Features Of Wealth Management Compared

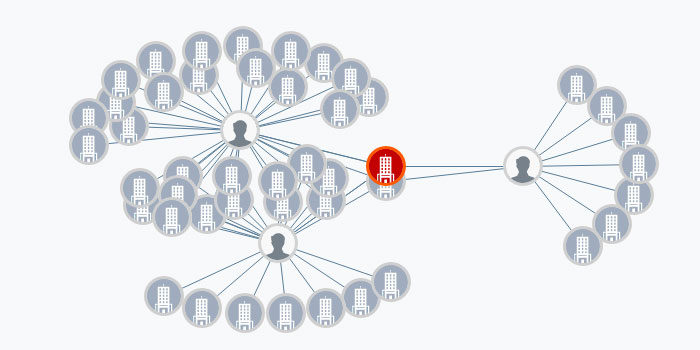

Although asset management and wealth management have some common ground, they also have important distinctions. The key difference between asset and wealth management is that the latter takes a broader view of the client's financial situation. In addition, wealth management emphasizes personal connections, while asset management is more commercial. Asset managers may engage with customers on a one-time basis to develop a tailored investment portfolio, whereas wealth managers often give continuing support to clients over the long term. Wealth managers typically provide a greater range of services compared to asset managers. In contrast to asset managers, wealth managers may offer more comprehensive services, such as financial planning, tax planning, estate planning, retirement planning, and more.

Asset Management's Perks

Clients can get many advantages from asset management, such as:

- Expertise in handling capital investments

- Portfolio diversification

- Opportunities for more diverse investments

- The potential for increased profits

- their risky investments are being actively managed

Wealth Management's Upsides

Among the many advantages that wealth management can offer, some of the more notable are:

- Methods that take the big picture into account

- budgeting that considers all of their expenses and incomes

- Individualized budgeting strategies that take into account their situation and objectives

- Investment management, tax preparation, estate planning, and financial services are available.

- Consistent help and advice from a trusted financial professional.

- Collaboration with additional advisors (such as lawyers and accountants) to keep their financial house in order

Conclusion

The financial services sector includes asset and wealth management, distinct specializations. While asset management is narrowly focused on administering a client's investments, wealth management considers the client's finances as their whole. Wealth managers offer various services to help their clients achieve their financial goals, such as financial planning, tax planning, estate planning, and more. Professional management of a client's investments, exposure to more investment options, the possibility of higher returns, and consistent assistance and advice from a devoted financial advisor are just a few advantages that asset management and wealth management offer clients. Each client's situation is unique, so it's vital to weigh all the factors before deciding which type of management is best for them—asset or wealth management.